As a general guidance the property crowdfunding framework under the guidelines sets out the requirements to be imposed on a property crowdfunding operator PCF operator. In 2019 licensed by the Securities Commission MyStartr was recognised as an equity crowdfunding ECF platform too.

Equity Crowdfunding Ecf In Malaysia Nexea

This new batch sees names that are familiar to those in the startup scene and some new names.

. They are expected to start operations by the end of 2015 the SC. Your one stop crowdfunding platform. The Securities Commission Malaysia SC announced at its virtual SCxSC fintech conference that more than 2500 Micro Small and Medium Enterprises MSMEs have raised more than RM1 billion through the regulated crowdfunding markets of the Malaysian capital market.

This is standard in the ECF industry. Ten ECF platforms have been registered to date. It said since its inception the total funds raised via equity crowdfunding ECF stood at RM42086 million.

The new equity crowdfunding players are. The six platforms are Alix Global Ata Plus Crowdonomic Eureeca pitchIN and Propellar Crowd. THE Securities Commission Malaysia SC has announced the approval of six registered equity crowdfunding platforms giving small businesses and entrepreneurs greater access to capital.

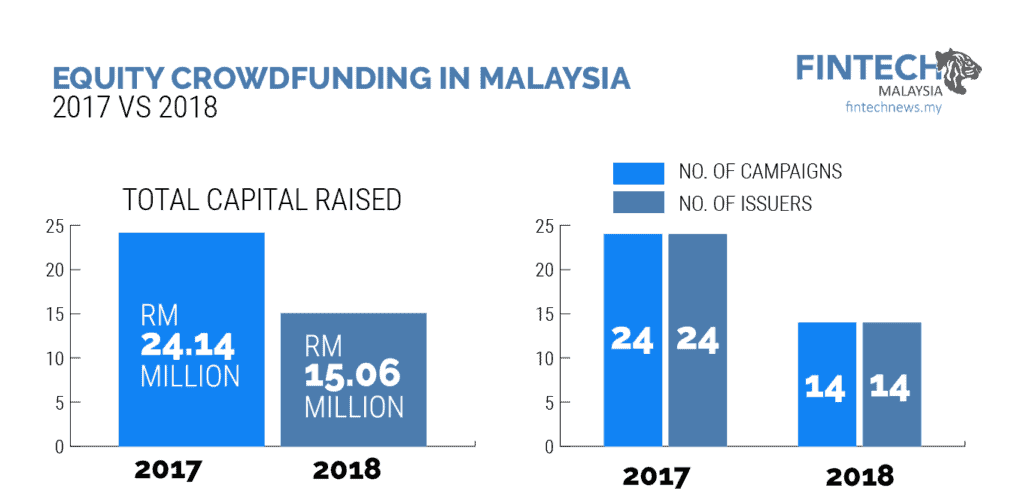

Nonetheless funds raised from ECF increased exponentially in the following two years recording a growth of 59 year-on-year in. This goes to pay for their operational costs in running the ECF platform. The Securities Commission Malaysia SC was established on 1 March 1993 under the Securities Commission Act 1993 SCA.

You can pick a registered equity crowdfunding platform from ten available. Ethis Malaysia which is part of Ethis Group is a Recognized Market Operator RMO approved under Securities Commission Malaysia to carry out Equity Crowdfunding business activities. The Securities Commission of Malaysia has allowed ECF operators to charge a certain percentage on the amount raised.

RM37 million growing 375 year-on-year while ECF reported negative growth in the same period. PitchIN The Home of Crowdfunding. Since then we had numerous ECF projects from small to medium sized companies with a variety of backgrounds such as platforms technology and food.

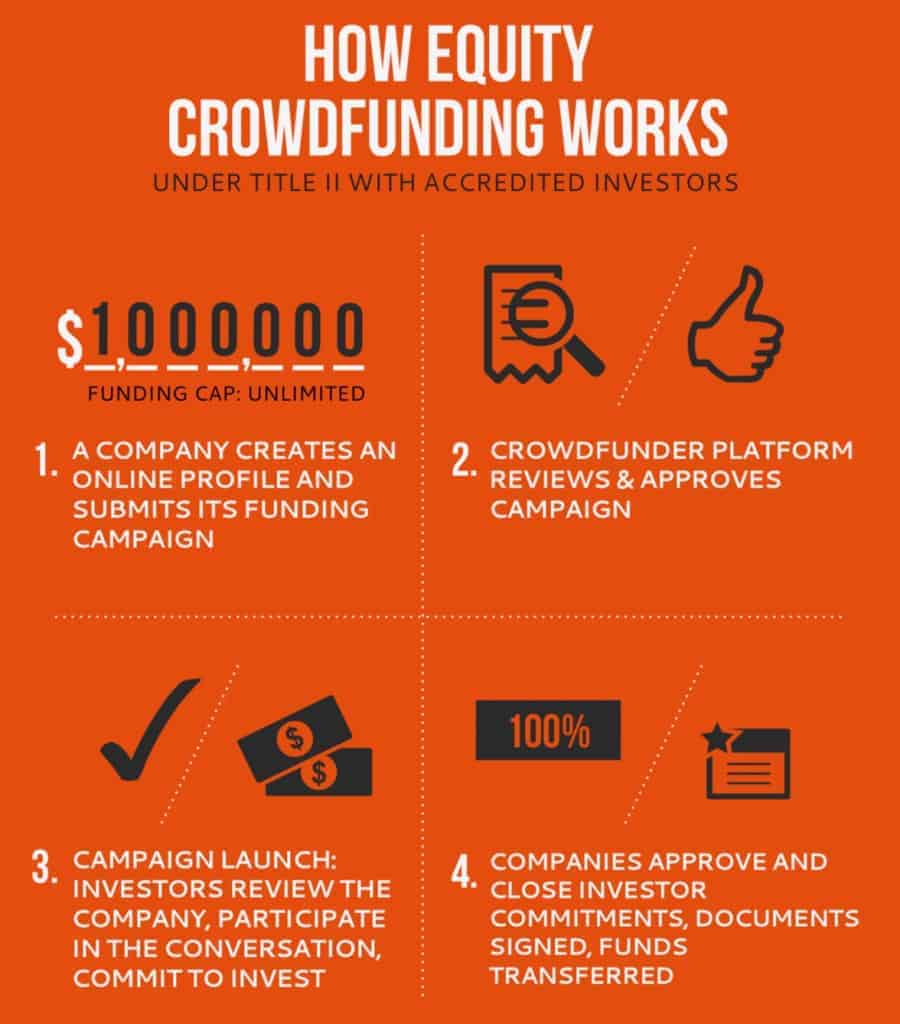

Equity crowdfunding ECF is an innovative form of alternative fundraising that allows small businesses to raise capital from the public using online platforms registered with the Securities Commission Malaysia SC. So far we have helped companies raise more than RM 64 Million. Your one stop crowdfunding platform.

For investors The ECF will enable investors to be a shareholder of such start-ups and SMEs and diversify their investments beyond the traditional asset classes. The Securities Commission of Malaysia SC regulates equity crowdfunding which is a type of alternative fundraising. There was a significant increase in 2018 mainly contributed by P2P crowdfunding raising close to RM180 million 2017.

According to Securities Commission of Malaysia SC crowdfunding guidelines only Malaysian companies and limited liability partnerships can be used as crowdfunding platforms. Securities Commission Malaysia today announced 3 new licenses for equity crowdfunding and 5 for P2P lending. We are a self-funded statutory body entrusted with.

1337 Ventures Ethis Ventures and MyStartr. The ECF therefore is a framework that enables start-ups and SMEs to access market-based financing through a platform registered with the Securities Commission Malaysia SC. Pitch Platforms Sdn Bhd is registered with the Securities Commission of Malaysia as a Recognized Market Operator for the purposes of offering Equity Crowdfunding related services.

KUALA LUMPUR March 28 The total funds via equity crowdfunding ECF raised increased to RM22163 million in 2021 from RM12773 million in 2020 the Securities Commission Malaysia SC said in its Annual Report 2021 released today. Since the introduction of the Equity Crowdfunding ECF and Peer-to-Peer Financing. For example if you raise RM3m the ECF operator will charge 7 RM210k as their fee.

We are best known for our crowdfunding impact investment for Indonesian social housing development projects which has been operational since 2014.

Sc Total Fund Raised Via Equity Crowdfunding Up 73 51 To Rm221 63m In 2021 The Edge Markets

Equity Crowdfunding Ecf In Malaysia Nexea

Crowdfunding Malaysia P2p Ecf Home Facebook

Securities Commission Malaysia Promotes Financing Opportunities For Small Business Including Crowdfunding P2p Lending Crowdfund Insider

Sc Malaysia Registers First Property Crowdfunding Platform

Equity Crowdfunding Ecf In Malaysia Nexea

Securities Commission Malaysia Crunchbase Company Profile Funding

Equity Crowdfunding Ecf In Malaysia Nexea

Securities Commission Malaysia Advances Greater Inclusivity In Promoting Equity Crowdfunding Crowdfund Insider

Securities Commission Malaysia Advances Greater Inclusivity In Promoting Equity Crowdfunding Crowdfund Insider

Equity Crowdfunding Ecf In Malaysia Nexea

The Securities Commission Malaysia Approves Edgeprop As First Property Crowdfunding Platform In Malaysia Crowdfund Insider

Sc Registers First Property Crowdfunding Operator Digital News Asia

An Alternative Investment Equity Crowdfunding Ecf In Malaysia Mcsb

The Risks Rewards Of Equity Crowdfunding In Malaysia For Business Owners Investors Entrepreneur Campfire

Pdf Equity Crowdfunding In Malaysia Legal And Sharia Challenges

First Profitable Bio Based Equity Crowdfunding Exit For Malaysian Investors Businesstoday

Securities Commission Malaysia P2p Ecf Operators Fintech News Malaysia

Finance Malaysia Blogspot Crowdfunding What Is Equity Crowd Funding Ecf